- Over 62 percent of bank customers had more than one bank account in 2023

- Nearly 70 percent of bank customers preferred mobile banking channels

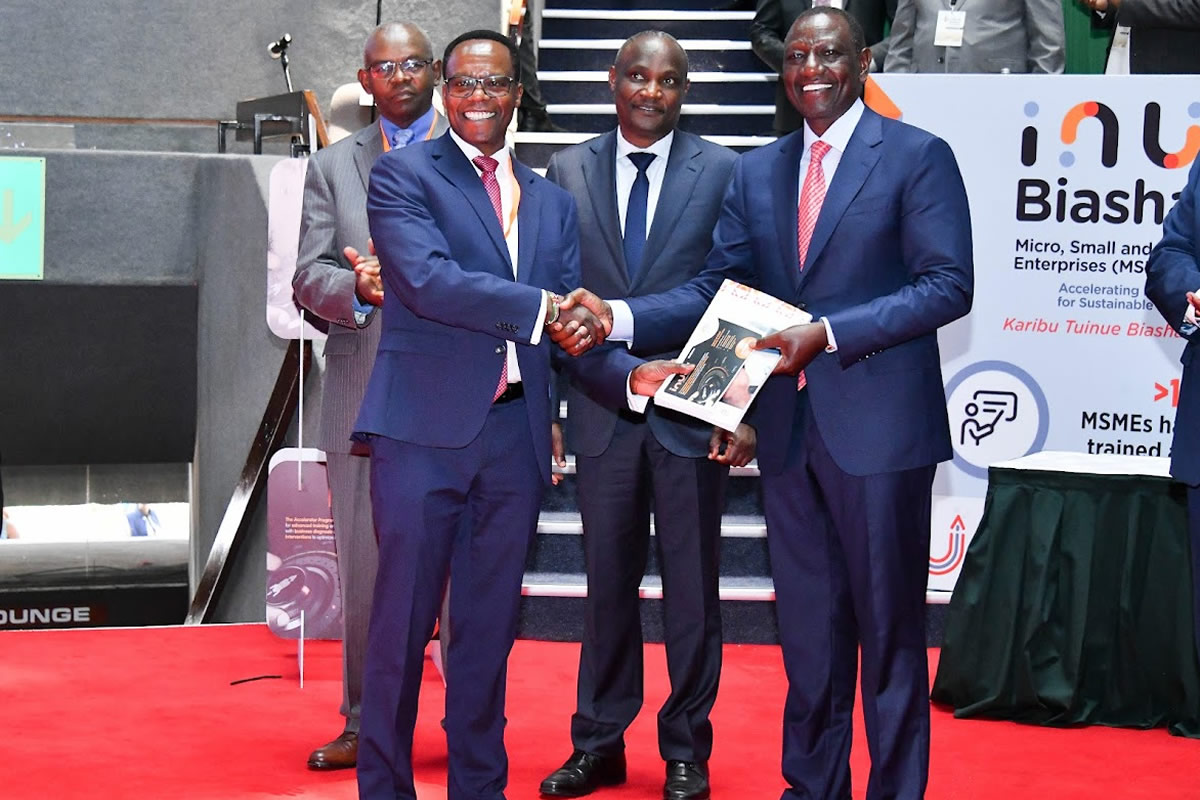

Nairobi, 5th March 2024: More than a half of bank customers maintained more than one bank account in 2023, in a trend that highlights a growing desire for customized convenience in services and products among bank customers.

According to the Banking Industry Customer Satisfaction Survey (2023) released today by Kenya Bankers Association (KBA), the level of bank clients with two bank accounts stood at 53 percent with the proportion of holders of 2 to 3 and 4 to 5 bank accounts representing 8.2 percent and 1.2 percent respectively.

The preference of digital and mobile banking channels to bank branch visits also continued to grow during the period under review, with preference for mobile banking rising to 69.9 percent from 67. 8 percent in 2022.

Kenya Bankers Association Chief Executive Officer Dr. Habil Olaka said the growing trend in multi-banking underscored increasing competition among players in the banking sector in product offerings as well as in customer experience.

‘’Considering the elevated level of flexibility at the banking public’s disposal, banks that prioritize the needs of customers will continue to have a significant competitive edge over the rest,’’ said Dr. Olaka.

Further, the survey findings place the access rate to banking services by Persons with Disabilities (PWDs) at 88 percent. However, 6.5 percent of PWDs still require a third party to access services, denying the banking population an opportunity to manage their finances independently and equally participate in the economy.

Dr. Olaka noted that the efforts are underway to address the challenge under the banking industry Persons with Disability Accessibility project. Coordinated by KBA, the project seeks to enable banks to put measures in place that will ensure full and independent access to banking services.

The survey respondents ranked Cooperative Bank as the best overall bank in customer experience, followed by NCBA Bank and Family Bank respectively. In the Tier I category, Cooperative Bank maintained the top position, followed by NCBA Bank and KCB Bank in position three. Meanwhile, Family Bank emerged best in the Tier II category with National Bank and Prime Bank taking the second and third positions respectively. ABC Bank topped in the Tier III category while Sidian and HFC Bank took the second and third positions respectively.

About the Kenya Bankers Association:

KBA (www.kba.co.ke) was founded on 16th July 1962. Today, KBA is the financial sector’s leading advocacy group and banking industry umbrella body that represents total assets in excess of USD 60 billion. KBA has evolved and broadened its function to include advocacy on behalf of the banking industry and championing financial sector development through strategic projects such as the launch of the industry’s first P2P digital payments platform PesaLink. In line with the Government’s policy on public-private partnerships, KBA and Central Bank of Kenya have implemented key projects such as modernization of the National Payments System through the Automated Clearing House, implementing the Real Time Gross Settlement System (RTGS), and the Kenya Credit Information Sharing Initiative. The KBA members are comprised of commercial banks and deposit taking microfinance banks. For more information, visit www.kba.co.ke.

Access Full Report Here: Banking Industry Customer Satisfaction Survey 2023

Media Contacts:

Christine Onyango

Director, Communications and Public Affairs

Email: conyango@kba.co.ke

Phone: 0711562910